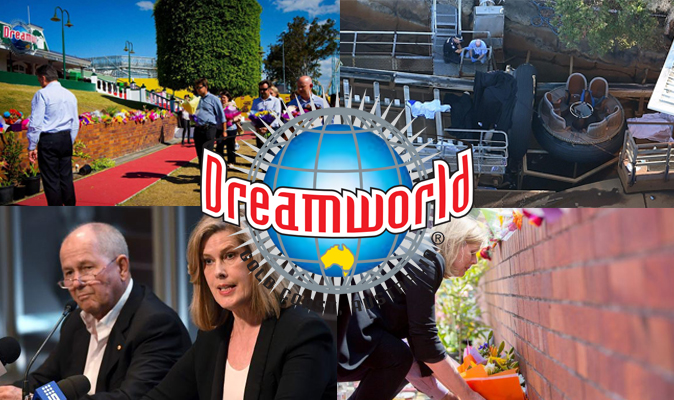

We’ve all seen that Dreamworld, and its parent company, displayed a woefully inadequate crisis plan. What are the lessons for the rest of us? How do we assess what crisis PR or Crisis Plan we need?

In my experience people tend to under-estimate the crisis plan a company needs. Mostly this isn’t a big deal; by definition, crises are rare.

A crisis is an event that potentially puts the company’s reputation or viability at significant risk.

For instance, the company I chair is a small consultancy with staff in an office, providing services by the hour. No dangerous machinery, just telephones and computers, so it’s unlikely there will be an injury leading to a crisis; low risk; physically, a rehearsed fire warden is about all it takes. There is a chance of reputation risk if someone says or writes something stupid, and for that prevention is better than a cure so we have levels of checking documents and there’s a caution about what we say. And we have the relevant insurances.

In my last job, at 60 Minutes, there was always the risk of a story going bad – a helicopter crash, being shot in a war zone, being jailed in Lebanon(!). A higher level of risk.

However, in a theme park, a school, an airline, a club, a large building site, a mine, anywhere where significant risk of injury or death is an issue, there first needs to be a culture of safety and risk aversion, and second, a higher level of crisis-readiness.

An airline needs a sophisticated crisis plan with a large team regularly rehearsed, and if it doesn’t have one for that extremely unlikely event, the results could be catastrophic. If Malaysian Airlines hadn’t been substantially government owned it would probably be out of business.

Crisis PR – Who’s to blame for a crisis?

Most crises are issues that escalate. Various surveys have calculated that between 80-90% of these are avoidable. There’s an allegation that the Dreamworld disaster was an accident waiting to happen.

In most companies, the board creates the safety culture of an organisation; the CEO or executive team, executes. So the board can be responsible for ensuring there is a crisis plan and the CEO makes sure the organisation is crisis-ready. Each needs the other, and each can apply pressure to ensure the other is up to scratch.

So, the Dreamworld board may have a lot of answer for, and Deborah Thomas, the CEO, may have in part been a victim – I don’t know. I do, however, suspect that various media commentators may have been hastily blaming Thomas for board responsibilities. But the CEO does need to be crisis rehearsed, and it’s clear by her answers in that infamous AGM/press conference that Ms Thomas wasn’t.

In companies where there is significant risk, it is wise to call in a professional to undertake desk-top exercises. With these a number of typical scenarios can be devised and then executed theoretically in a round-table discussion. Two typical scenarios that seem to come up regularly are a catastrophic accident and a serious sex abuse incident that goes public.

There is also value in having someone in your crisis management team who’s seen it all before. Hence the role for an external professional. A crisis may be rare for you, but not for a professional, and there is a pattern. That person can objectively anticipate problems. And it’s impossible for a crisis plan to anticipate the fluidity of a crisis, so there’s a need for a whole raft of judgement calls along the way. Your organisation’s values should help drive those calls, but taking advice from someone with experience in previous crises also helps – it would have helped Ms Thomas.

Crisis PR: It’s about values

John Carver, one of the gurus of board function, writes that a good board has processes that probe and uncover its own and the CEO’s deficiencies:

“In conceiving … policies, the board should not focus just on current worries. A board should create … policies that cover the entire range of unpalatable circumstances. What a board would find unpalatable is not a function of recent events. … Reactive policymaking takes responsive action at the time of a crisis, but this indicates that the board’s leadership is driven by circumstances rather than by ideals. The idea is to design a system for whatever the future holds, not just to fix today’s or yesterday’s problems. When it is free of concerns, the board uncovers values … relevant to events as yet unforeseen.”

In summary, in crises that most of us can remember:

- The board at Dreamworld may have a lot to answer for.

- As did the board of Malaysian Airlines.

- The BHP board was not sufficiently across safety issues to prevent the 2015 Brazilian mine disaster, but when it happened a crisis plan appears to have been executed really well.

- The BP board was seriously caught with its pants down with a myriad of safety breaches that led to the 2010 Bay of Mexico oil spill, and they weren’t rehearsed for the crisis, which included lying to the US Congress. Mistakes heaped upon mistakes and eventually the US government stepped in, for four years, to monitor the company’s ethics and safety practices.

- Likewise, the 2011 Fukushima nuclear plant accident revealed horrendous board and management deficiencies before and after the accident.

- The Catholic Church is probably the most notorious example, ever, with the crisis that could have been prevented, and when it occurred, was bungled again and again and again.